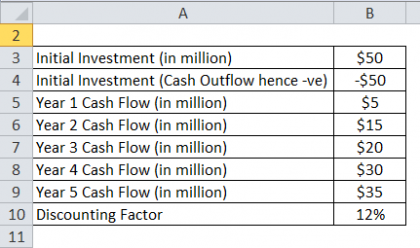

You’ll enter your business’s expected annual growth, the weighted average cost of capital, and the number of years of cash flow you want to include, as well as the cash flow you get from operations and from investing. The math can get complicated, so Zion Bank offers a discounted cash flow calculator tool for exactly this reason. Discounted cash flow calculatorĭiscounted cash flow is another way to measure a business’s value, and it’s mostly used by real estate or other investors to see if a potential investment is worth it. You can also use these calculators on personal loans, if that’s helpful. This tool can be helpful before borrowing to ensure you can afford your monthly payment before applying. Once you input your total amount borrowed and the interest rate, along with any fees and the length of your repayment period, you can see what you would pay each month instantly, as well as how much you’ll pay over time. Nav’s term loan APR calculator can also tell you what monthly payment to expect.

TOP RATED FINANCIAL CALCULATORS HOW TO

To get started, check out Nav’s guide on how to establish business credit. When you’re applying for any small business loan, first make sure your business credit is up to snuff. The calculator will show you the total cost of funding, as well as your APR. Simply input your loan amount, interest rate, any fees, number of years or months in the repayment period, and any monthly service charge. If you’re looking to try invoice financing, you can also take a look at the helpful calculator for invoice financing.įor more traditional term loans, you might find Nav’s term loan APR calculator to be a help. This calculator can help with loans that require daily payments. If you’re looking to get a loan from an alternative or online lender, check out OnDeck’s APR calculator. The business interest rates calculator you use to determine how much you’ll pay in interest depends on the type of funding you’re taking out. We’ll do the heavy lifting for you to calculate your cash flow details. Nav’s Cash Flow Tool offers actionable insights that you can’t get elsewhere - and all it takes is for you to sign up with Nav and connect your business checking account. Luckily, Nav added new features to its Cash Flow Tool, like projected monthly net income and month over month net income change. Cash flow sounds very simple, but it can get complicated, which is why using a calculating tool can be so helpful. It’s one of the most essential measurements to use to be able to run your business smoothly and to understand your business value. Business cash flow calculatorĬash flow is the difference between the money coming in and going out. Here are the best business loan calculators you can use to make running your business smoother and more cost effective. It’s best to feel confident with your business’s financial health.

TOP RATED FINANCIAL CALCULATORS SOFTWARE

And although business calculators can help you with the math, turn to accounting software or a financial professional if you’re unsure. You may not need to know all these terms since not all of them apply to each calculator. Or, in other words, It’s one way to determine the value of a business.

Weighted average cost of capital: When you’re looking at the discounted cash flow calculator, the weighted average cost of capital is one way to figure out how much it costs to invest in a business.Capital expenditure: The cost of buying, upgrading, or maintaining a physical business asset, like equipment or property.

For example, you may have a two-year repayment period on a loan, which means it needs to be fully repaid by the two-year mark.

Most spreadsheets and accounting software can calculate amortization for you. Amortization: On a loan, an amortization schedule is basically the monthly payments you make on the loan to reduce its size over time.The terminology isn’t always simple when you’re using a business calculator, so here are a few terms that may be useful to know going in: You can find a business calculator that can help you with determining exactly how much you’ll pay on those small business loans you’re eyeing or deciding which project to pursue. Running a small business is hard enough - using a business calculator takes much of the guesswork out of calculations for some of business operations. Know what business financing you may qualify for before you apply, with Nav. Instantly, compare your best financial options based on your unique business data. Spend more time crushing goals than crunching numbers.

0 kommentar(er)

0 kommentar(er)